- Article

- Sustainability

- Transition to Net Zero

Moving ahead on the road to net zero

Transport and logistics companies understand the urgent need to reduce their consumption of fossil fuels and are exploring all routes to a low-carbon future.

Transport and logistics companies see the transition towards a low-carbon future as key to the future of their businesses. As regulators, consumers, investors, and supply chain partners step up their efforts to combat climate change, these firms are making decarbonisation a top priority.

In its second instalment of the HSBC Transition Pathways series, which looks at business sentiment and the decarbonisation of industries, HSBC worked with Kantar to ask over 300 transportation and logistics companies in the air, maritime, road (automakers were not included), rail and logistics sectors, across 16 markets, how they are steering their businesses towards net zero (see methodology below).

Following a similar analysis of the energy sector, this new survey provides insight into the drivers and roadblocks facing transport and logistics businesses as they decarbonise. It also reveals how transport companies are thinking about net zero targets, capex expenditure and wider enablers such as finance and partnerships.

The survey shows that a significant majority of transport companies see a strong business case for transitioning to net zero. In fact, the bulk of respondents believe reducing emissions is integral to achieving their business goals and almost nine in 10 (88%) say net zero is important to commercial growth.

A more granular look reveals that decarbonisation is top of mind for many companies, even where the transition pathway remains less clear. Nine in 10 companies in the air and maritime sectors say net zero is one of their top three business priorities – compared to around three out of four in the road, rail, and logistics sectors.

The findings also show that net zero is commercially more important to companies that carry both passengers and freight, with 38% listing it as their top priority – compared to 27% of companies that deal with freight alone.

Drivers and roadblocks: How are transport and logistics businesses approaching the low-carbon transition?

Accelerators and decelerators

For the companies in the survey, technological developments ranked as the most powerful net accelerator of the transition, followed by reputational concerns and market demand.

Geopolitics, food security and government policy were among the top net zero accelerators for businesses in the air and maritime segments – a reflection of their importance to international travel and trade.

Logistics companies ranked energy costs and energy security as major accelerators, a sign that geopolitics and volatile energy prices are bolstering the case for a shift away from fossil fuels. Although they have recently come back down, electricity prices in the UK, for example, rose by 66.7% and gas prices by 129.4% in the 12 months to January 2023.1

Meanwhile, reputation emerged as the top accelerator for the road and rail sectors, a sign of the importance of consumer recognition to business outcomes.

We see clear evidence that transport and logistics businesses are responding to pressure from consumers and stakeholders and taking responsibility for their emissions.

|

“Global businesses understand they cannot wait for the perfect zero-carbon solution to become available and are embedding strategies that take advantage of technology today, such as sustainable fuels and electrification – as our findings show.” He adds.

Routes to decarbonisation

Almost two-thirds of transport and logistics companies are tracking their progress against a dedicated reporting plan, according to the survey. However, plans and transition levers vary markedly across the sector depending on business size and modes of transport.

Notably, the survey revealed a gap in transition planning between large companies and small businesses. Some 55% of businesses with annual revenues of at least US$500m have set emissions targets for scope 1 and 2 emissions – those that come directly from companies’ operations or the electricity they purchase, respectively. At the other end of the scale, 36% of companies with revenues below US$10 million have set similar targets.

Among companies with a net zero target for scope 1 and 2 emissions, 89% are aiming to reach their goal by 2035.

"This shows the need for smaller companies to understand their emissions and set targets, given the external pressures they face. Echoing our energy findings, it is often the larger, listed companies in the transport sector that are moving first to meet market demands,” says Seb Henbest, Global Head of Climate Transition at HSBC.

The actions companies are taking to reduce scope 1 and 2 emissions vary depending on sector. Increasing the use of new low and zero-carbon fuels ranked as the top priority among air and shipping firms, with around a third (34%) working to reduce their reliance on carbon-based fuels.

Road and rail companies, meanwhile, see charging infrastructure (30%) and emissions-based carbon charges on top of existing pricing (30%) as the key levers for cutting scope 1 and 2 emissions.

Logistics businesses are especially focused on improving energy efficiency (31%) and switching to electric vehicles (30%).

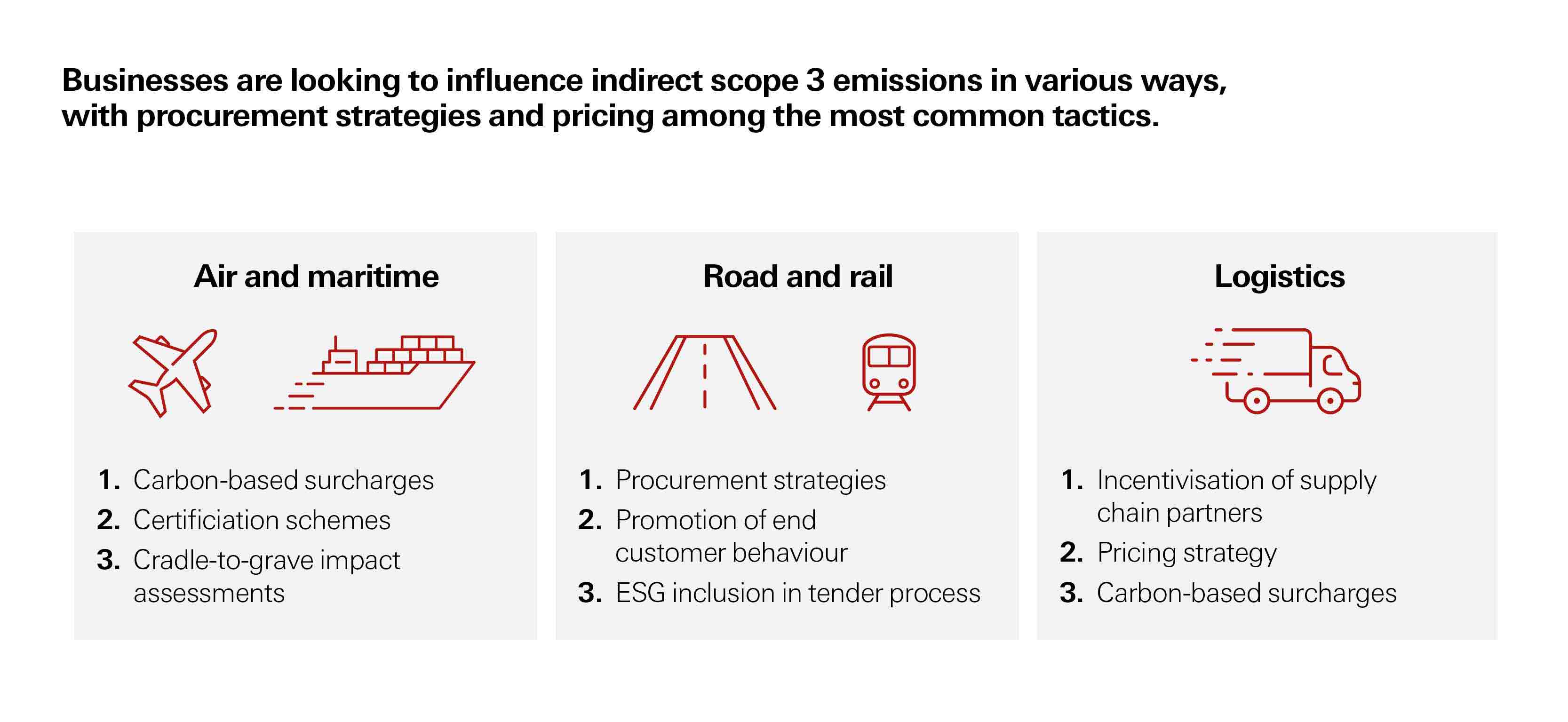

Influencing scope 3

While scope 1 and 2 emissions are the primary focus for most transport operators, many businesses are seeking to address scope 3 emissions – those they generate indirectly via their supply and value chains.

Procurement policies ranked as the most popular method (47%) among survey respondents, followed by promoting sustainable end-customer behaviours (46%) and passing on carbon charges via pricing to customers (45%).

However, these upstream and downstream emissions are challenging to assess and not yet widely reported: only 15% of the companies surveyed have a scope 3 target.

"Many transport companies will be tempted to look at Scope 3 emissions as a lower priority - a typical shipping company, for example, generates over 90% of its carbon footprint as scope 1 emissions in burning marine fuel,” says Henbest. “However, it is important for companies to consider all levers when it comes to decarbonisation. Customers, financiers and other stakeholders increasingly expect to see companies taking action across their value chain.”

Financing change

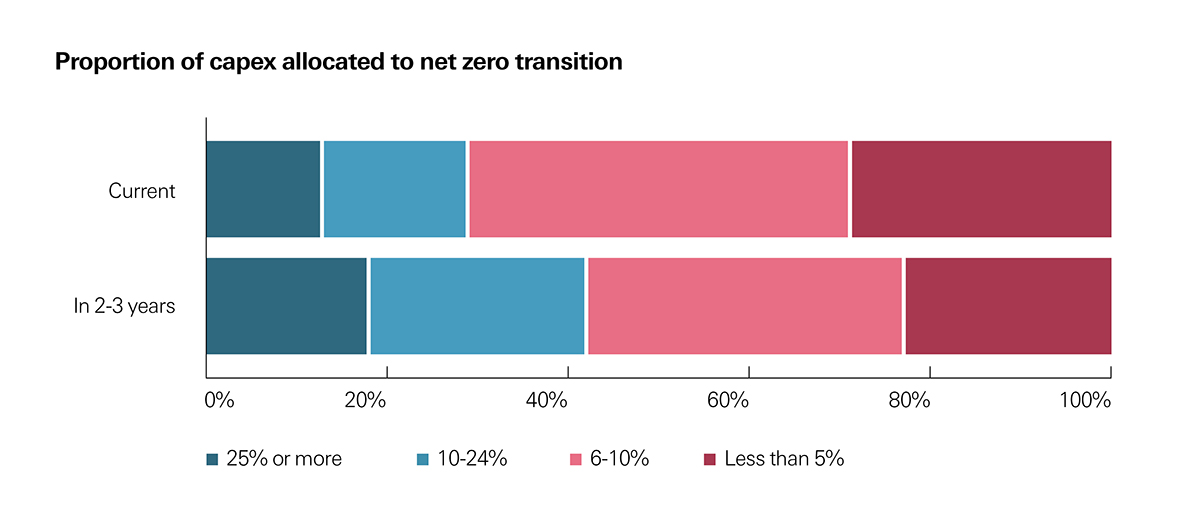

Transport businesses in general expect to increase their spending on net zero initiatives over the next two to three years. Today, 29% of companies are already allocating more than 10% of their capital expenditure towards decarbonisation, and 42% plan to do so in 2-3 years’ time.

“The top destinations for current spending are low-carbon solutions for their own operations, along with fleet management, transition to sustainable fuels and emission reduction retrofitting,” explains Connor.

Larger companies are ahead in terms of allocating finance for their transition. Only around one in 10 small and medium-sized enterprises (SMEs) are allocating over 10% of their capital expenditure towards transition initiatives, compared to one-third of the large companies surveyed.

Even though capex overall is forecast to increase, almost a quarter (23%) of transport and logistics businesses still expect to spend less than 5% of capex on their net zero transition in two to three years’ time.

Costs and availability of finance were cited as the main hurdles preventing companies from taking further action – echoing the findings in our survey of energy companies.

“Transition financing is available for companies that are looking to increase capex spending on emissions reduction,” adds Connor. “As capital providers look to decarbonise their own portfolios, a clear and credible transition plan will become more important in determining access to finance streams.”

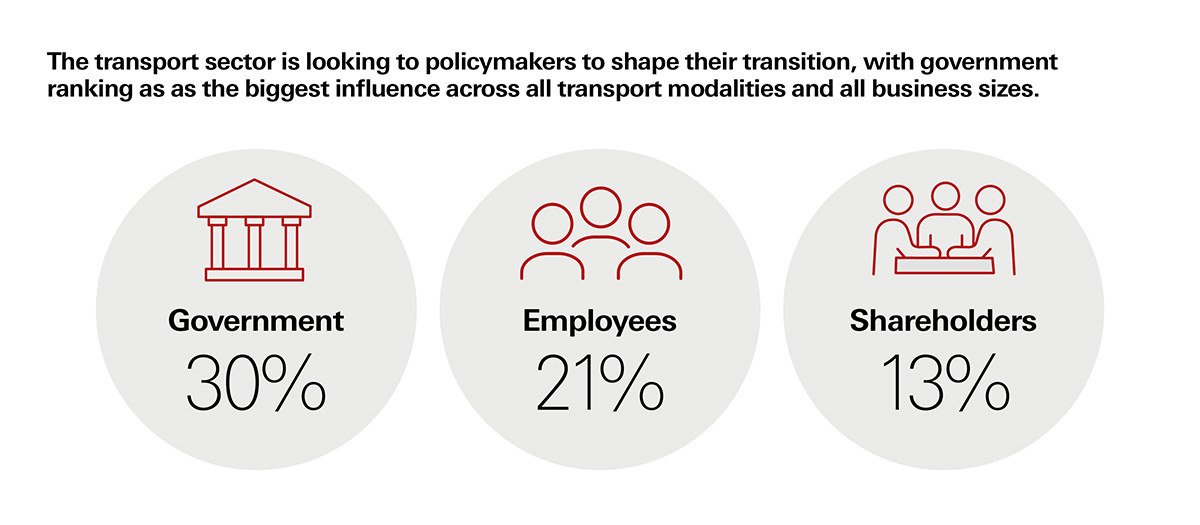

Moving up a gear

The survey found that transport companies are looking to policymakers to help shape their transitions, with governments cited as the biggest influence on net zero strategies. Government funding is also the top source of financial support for the transition, especially for businesses in the air and maritime segment.

The survey shows that companies expect private sector funding – including bank lending, venture capital/private equity investors and public shareholders – will remain equally important over the next 2-3 years.

Transport and logistics companies are also looking for additional support from their financing partners: 37% of respondents are interested in advisory services from banks in the future, including risk management, frameworks and disclosure reporting, while 30% expressed an interest in net zero tools – such as carbon calculators and transition solutions - up from 22% using them today.

But the role of governments in providing financial support will remain critical: 40% of companies with annual revenues over US$500m still expect to use government funding in their emissions reduction in 2-3 years’ time.

“Governments and regulation will be key to creating new markets for low-carbon mobility solutions, such as sustainable aviation fuel. But companies cannot depend on government funding as their primary source of finance,” says Connor. “In time, this will need to be replaced by private investment.”

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. Find out more: https://www.hsbc.com/who-we-are/our-climate-strategy

For HSBC’s Transition Pathways survey, HSBC has worked with Kantar. The survey is not limited to or wholly-representative of HSBC’s customer base and covers 302 key financial decision makers from businesses operating in the transport sector, comprising Road and Rail (108 businesses, with Road covering freight/services and excluding autos/passenger) Air and Maritime (64 businesses) and Logistics and Delivery (93 businesses). The survey findings and responses have not been independently verified. Businesses were further identified as Freight only (148), Passenger only (49) and those transporting both freight and passenger (105).

Businesses were located across Europe (137), North/Central America (77), Asia (52) and the Middle East (36). Overall, 61 (20%) had a turnover between $5 and $10m, 101 (34%) had a turnover between $10 and $500m, 140 (46%) turnover in excess of $500m of which 65 (22%) had a turnover in excess of $2.5bn. The majority, 191 (63%) had been established for more than ten years and a further 63 (21%) for more than five years.

Data was collected through an online questionnaire and the survey ran for three weeks from 28 September to 18 October 2022.

In preparing this survey, HSBC has relied upon appropriate available data, information and responses given at the time of writing. This report should not form the basis of any third party’s decision to undertake, or otherwise engage in, any activity and third parties do not have any right to rely on it. Neither HSBC nor Kantar accept any duty of care, responsibility or liability in relation to this research or its application or interpretation, including as to the accuracy, completeness or sufficiency of it or any outcomes arising from the same.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (“HSBC”) and is for the exclusive use of the person to whom it is provided. It is intended for reference and illustrative purposes only. It does not constitute an offer or solicitation for, or advice or recommendation that you should enter into any transaction with HSBC or any of its subsidiaries or affiliates.

HSBC has based this Document on information obtained from sources it believes to be reliable but which it has not independently verified. All information contained in this Document (including without limitation, information about products, terms and conditions, pricing, forecasts, market influences and HSBC policy) is subject to change from time to time without any obligation on HSBC to give notice of such change to you.

HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability for the contents of this Document and/or as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Document to the maximum extent permitted by law. You are responsible for making your own evaluation about the products referred to in this document. HSBC recommends that before you make any decision or take any action that might affect you or your business, you consult with suitably qualified professional advisers to obtain the appropriate financial, legal, accounting, tax or other advice.

© Copyright. The Hongkong and Shanghai Banking Corporation Limited 2023, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC.