- Article

- Sustainability

- Transition to Net Zero

- The Future of Infrastructure

- General Sustainability

Building towards net zero

Our survey of property developers and investors shows the emissions-heavy real estate sector is stepping up its focus and capex spending on decarbonisation.

The real estate sector is an important area of focus to limit climate change. Including direct and indirect emissions generated in their construction and operations (including energy use), buildings account for around one third of annual greenhouse gas emissions, according to the International Energy Agency.1 Property developers and investors are increasingly recognising the importance of building more sustainably, for the benefit of both the environment and their bottom lines.

In the third instalment of the HSBC Transition Pathways series, which looks at business sentiment and progress on the decarbonisation of industries, HSBC worked with Kantar to ask some 320 real estate developers and investors, across 20 markets and various sub-sectors, how they are moving towards net zero (Please see below for the full methodology).

Following a similar analysis of the energy and transport sectors, this new survey provides insight into the opportunities and challenges that decarbonisation poses to the property industry. It reveals what developers and investors in the sector – across office, retail, hospitality, logistics and data centres – are prioritising in terms of capex expenditure, financing and other issues in respect of their net zero plans.

Sentiment and strategy

Almost all (97%) real estate companies globally see net zero as commercially important to their business growth. Indeed, 43% say it is fundamentally important, rising to around six in 10 in Europe and the UK.

More developers (47%) say it is fundamentally important to their business than investors (38%), reflecting perhaps the former group’s more direct, physical involvement in the industry.

Size is also a factor here. Six in 10 (59%) of the largest real estate companies (those with gross asset value (GAV) of USD$5 billion or more) see net zero as their top business priority, compared to 32% of smaller firms (GAV of less than USD$1.5 billion).

“Companies with bigger scale tend to have more resources – and to be under greater pressure from government and society – to address decarbonisation,” says Seb Henbest, Global Head of Climate Transition at HSBC.

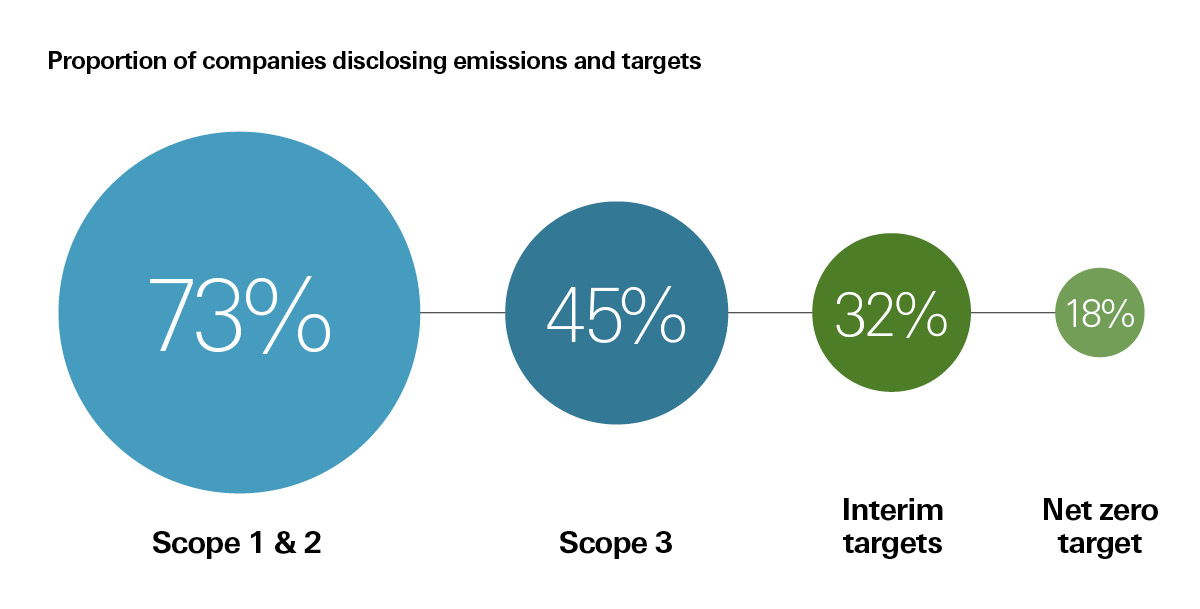

The importance that property businesses are assigning to the transition is reflected by their emissions reporting. Nearly three-quarters (73%) are disclosing on scope 1 and 2 (those directly related to their business operations and those related to the energy they use, respectively) and close to half (45%) on scope 3 (emissions related to their supply and value chain).

However, fewer than one-fifth (18%) of businesses surveyed have committed to a net zero target, and only one-third have set some level of interim targets that will help reduce their emissions.

“Real estate developers and investors face major challenges, ranging from finding robust low-carbon construction materials to obtaining energy usage data from tenants who can be reluctant to provide it,” says Ali Razvi, Head of EMEA Real Estate and MENAT Real Assets Investment Banking Coverage at HSBC.

Nonetheless, some businesses are setting the pace, and momentum is increasing. Globally, over one-third (36%) of real estate companies claim they have already published a clearly defined plan to tackle carbon emissions, or plan to do so in the next 12 months. This rises to 50% for European respondents and just over half in the UK.

Breaking down the figures by types and sizes of company, 39% of developers say they have a clearly defined net zero plan versus 28% of investors, while the number is 43% for large businesses compared to just 25% of small firms.

“One would expect the real estate sectors in Europe and the UK to be setting the pace on emissions targets, measuring and reporting because they face tighter environmental regulations,” says David Stephens, Head of Real Estate Finance, London at HSBC UK. “It’s good to see them moving quickly on this, but perhaps even more significant that they are raising the bar for other regions.”

Actions and investment

So what practical actions are real estate developers and investors likely to take as part of their transition strategies?

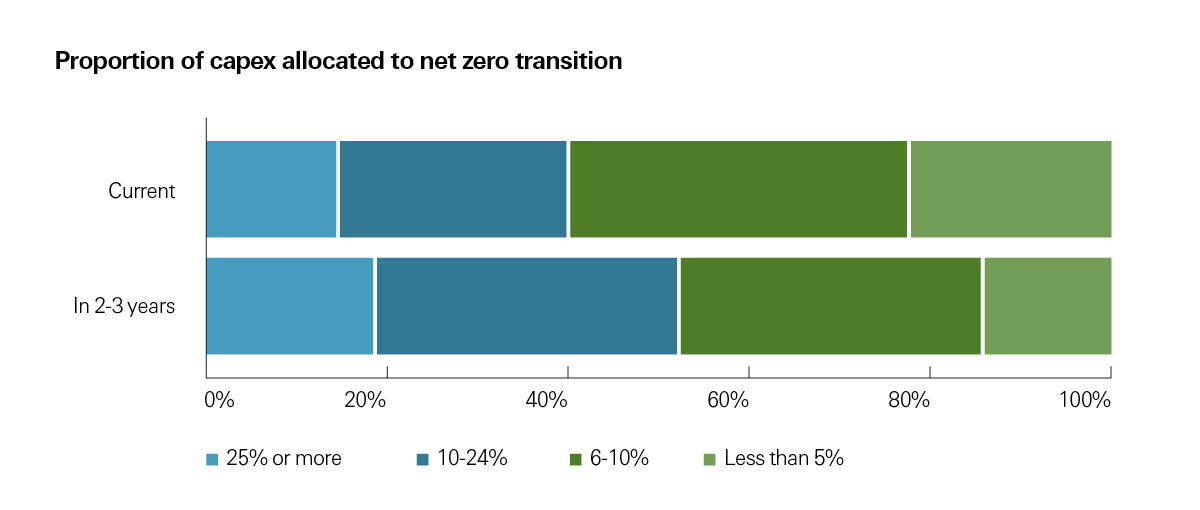

A crucial trend is that they aim to increase their spend on decarbonisation. About four in 10 (39%) of respondents are spending at least 10% of capex on their net zero transition currently, with around half (51%) expecting to do so within three years.

As for what they will spend it on, the top three stated capex priorities globally are energy efficiency, electrification and securing renewable power generation. Waste and water optimisation is also particularly important in Asia, while newer businesses are much more likely to prioritise carbon offsets and portfolio optimisation.

In line with these priorities, real estate companies – particularly in Europe and the UK – see electrification of on-site operations (such as switching gas boilers to heat pumps) and installation of EV charging as the most impactful activities to reduce carbon emissions.

However, only around one-quarter of respondent firms globally have undertaken those two activities, potentially indicating the high cost and difficulty of doing so. The most widely undertaken activity has been to reduce carbon emissions through staff incentives and initiatives perhaps because they are relatively quick, easy and low-cost to implement.

Property developers and investors have different priorities in certain areas, including switching to renewable energy (29% of developers saw this as a spending priority versus 20% of investors) and installation of EV charging (26% versus 16%).

Drivers and opportunities

Ultimately, rising overall investment in transition activities suggests net zero activity will ramp up across the board in the coming years. After all, real estate companies feel net zero offers commercial benefits, with transparency of supply chains and cost savings seen as the biggest business opportunities from the transition.

“These findings underscore the importance of an in-depth understanding of the entire value chain for any real estate company looking to improve energy efficiency and save on costs. It is encouraging to see that businesses in the sector see this as a core part of the commercial case for decarbonisation,” says Stephens.

What’s more, the net zero transition is affecting their approaches to tenders and mergers & acquisitions.

Seven in 10 believe their net zero strategy receives significant weight in customer contracts; and for one in five say it is a mandatory or determining factor. Around two-thirds (68%) of businesses say ESG credentials have a significant impact on their M&A activity, with the figure higher among big companies. In Europe, they are a mandatory or determining factor for a third (34%) – the highest of any region.

“We are witnessing an increasing focus on all things ESG by clients looking at in-region or cross-border M&A in the real estate sector,” says Razvi. “Especially when it comes to environmental considerations, but also taking into account social/governance considerations for markets where it makes sense to do so.”

Finance as an enabler

Real estate businesses have good reasons to be increasing their focus and spend on reaching net zero, but they recognise they will heavily rely on the availability of financing and technology to get there.

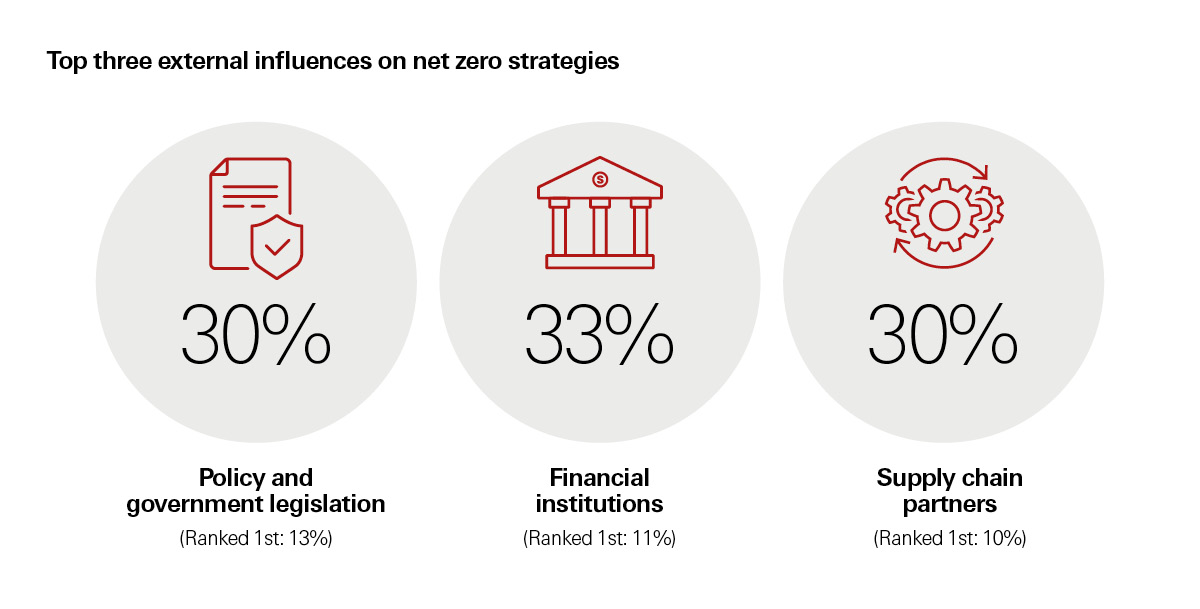

Financing also appears – alongside policy and government legislation – at the top of the list of factors cited by respondents as having the greatest influence on net zero strategies.

"The property sector will have to spend a huge amount of capital on decarbonisation over the coming decades, and access to capital will be critical," says James Richards, Head of Commercial Real Estate, HSBC US. "Capital providers and financial institutions are in a position to set the direction and influence the speed of the transition."

Public finance is one channel that they will seek to tap. More than a third (36%) of property companies are looking to government funding as a future source of finance for their net zero transition.

Banks will be another, as well as a source of information. When asked about services that banks could provide around the transition, real estate businesses ranked research and insights into decarbonisation as a close second after sustainable financing.

In addition, 37% expressed interest in tools and solutions from lenders, up from the 25% that use them today. In the UK, HSBC has joined a pilot with sustainability consultancy CFP Green Buildings to offer clients the HSBC Green Buildings Assessment Tool, an interactive digital platform that can help businesses identify energy efficient investments in buildings and build a sustainability strategy for their portfolio.

“HSBC is focused on further enhancing and expanding the range of sustainable finance, research and other solutions it can offer companies and investors in the property sector, in line with the growing demand,” adds Razvi.

While the long-term nature of real estate assets means the net zero transition will not happen overnight, the responses to this survey show a determination to take action and a willingness to invest in more sustainable solutions at every level of the value chain.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. Find out more: https://www.hsbc.com/who-we-are/our-climate-strategy

For HSBC’s Transition Pathways survey, HSBC has worked with Kantar, a data, insights and consulting company. The survey is not wholly-representative of HSBC’s customer base and covers respondents across 321 key financial decision makers from businesses operating in the Real Estate sector, comprising Developers (163) and Investors (158) and operated across Residential and Office, Retail and Hospitality and Logistics and Data Centres. Businesses were located in Europe (61, of which 35 were in the UK), Asia (97, of which 43 were in Hong Kong), the Middle East (31) and North/Central America (132). Overall 146 (45%) had a gross asset value below $1.5bn, 67 (21%) had a gross asset value between $1.5bn and $4.9bn and 108 (34%) had a gross asset value in excess of $5bn. 99 (31%) had been established for less than 10 years and 222 (69%) for more than 10 years. Data was collected through an online questionnaire and the survey ran from 5 to 17 July 2023.

In preparing this survey, HSBC has relied upon available data, information and responses given at the time of writing. This report should not form the basis of any third party’s decision to undertake, or otherwise engage in, any activity and third parties do not have any right to rely on it. Neither HSBC nor Kantar accept any duty of care, responsibility or liability in relation to this research or its application or interpretation, including as to the accuracy, completeness or sufficiency of it or any outcomes arising from the same.

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (“HSBC”) and is for the exclusive use of the person to whom it is provided. It is intended for reference and illustrative purposes only. It does not constitute an offer or solicitation for, or advice or recommendation that you should enter into any transaction with HSBC or any of its subsidiaries or affiliates.

HSBC has based this Document on information obtained from sources it believes to be reliable but which it has not independently verified. All information contained in this Document (including without limitation, information about products, terms and conditions, pricing, forecasts, market influences and HSBC policy) is subject to change from time to time without any obligation on HSBC to give notice of such change to you.

HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability for the contents of this Document and/or as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Document to the maximum extent permitted by law. You are responsible for making your own evaluation about the products referred to in this document. HSBC recommends that before you make any decision or take any action that might affect you or your business, you consult with suitably qualified professional advisers to obtain the appropriate financial, legal, accounting, tax or other advice.

© Copyright. The Hongkong and Shanghai Banking Corporation Limited 2023, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC.